Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an executive editor who has a joint income of $180,000 per year and spends some of her money this week on gummy bear earrings.

Occupation: Executive Editor

Industry: Media

Age: 34

Location: New York, NY

My Salary: $100,000

My Husband’s Salary: $80,000

Net Worth: $407,300 (apartment: $520,000, joint checking: $13,000 (we use this account to pay for all of our expenses), joint savings: $50,000 in a high-yield savings account, $500 in another savings account as a backup, my Roth IRA: $35,000, my 401(k): $40,800, joint mutual fund: $60,000, personal mutual fund: $85,000, joint Stash investment account: $8,000, minus mortgage.)

Debt: $405,000 mortgage balance

My Paycheck Amount (2x/month): $2,600

My Husband’s Paycheck Amount (2x/month): $2,000

Pronouns: She/her

Monthly Expenses

Mortgage: $1,800 (for our two-bedroom co-op apartment in Manhattan)

Apartment Maintenance Fee: $950

Utilities: $100

Internet: $70

Subscriptions: $50 (Photoshop, Google Storage, NYTimes and Washington Post subscriptions)

Phone: $0 (both of us are still on our parents’ plans)

Netflix/HBO/Hulu: $0 (share with family)

High Yield Savings: $2,000

Mutual Funds: $1,550

Roth IRAs: $1,100 (combined for both IRAs)

Stash Investments: $100

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, I was expected to go to college and stay within a three-hour radius of my family. Both of my parents loved college and spent my entire childhood raving about how amazing their college experiences were. I had a completely different experience — I chose a university and ended up transferring in the middle of my sophomore year, which was very taboo. I did not love either university I enrolled in. I was ready to be an adult and just wanted to start working and living in NYC. My parents very generously paid for my college education in full.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My mom was a stay-at-home mom and was very conscientious about money. My dad worked a corporate full-time job and advanced to an upper management position. We definitely had a solid middle-class upbringing — we lived in a nice house and then moved to a much larger one when I was in middle school. My parents had a beach condo that we would use/they would rent out. We went on a few vacations per year, had season passes to go skiing at a mountain nearby, and always had fun toys, nice birthday parties, etc. I definitely think my parents had different attitudes toward money — my dad acted from abundance (though not over-the-top) and my mom had a scarcity mindset. I definitely mirrored her mindset in my own attitude about money. We never talked about specific dollar amounts; I just always tried to save as much as possible.

What was your first job and why did you get it?

My first job was babysitting at age 13. Once I got to high school, I worked at a summer camp for two summers, and then at various restaurants in my town. I was always wanting to make money just to save. I got my first car at age 17 and then used my earnings to pay for gas.

Did you worry about money growing up?

Yes! My mom was very frugal and had a mindset that unless something was absolutely necessary, we didn’t need to buy it. Even though we were actually quite well-off, I definitely had a lot of stress and anxiety around money and was very focused on saving and working at a young age.

Do you worry about money now?

Yes! But now I have better control over my anxiety and can recognize when I’m not being logical about purchases. My husband has helped with this a lot. When he wants something, he buys it, and his concept of expensive is much different from mine. Fortunately, he’s not an extravagant spender or impulse buyer; he just doesn’t stress about going out to eat or buying new clothes when he wants them. This has helped me loosen up about minor purchases, but I’ve also helped him become more conscious about money. Together we’ve saved a lot, started investing together, and learned more about financial literacy.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I’ve been paying my rent and bills since I moved out of my parents’ house when I was 23. I’ve been unemployed multiple times over the last 10 years and I’ve been able to rely on my own savings to support myself, though I know that my parents or my husband’s family would help me. I feel like either set of parents would be more than happy to just have us move right back in with them!

Do you or have you ever received passive or inherited income? If yes, please explain.

My husband’s dad gifted us $14,000 toward our down payment for the apartment.

Day One

6:30 a.m. — Up with the sun. I spend time scrolling the NY Times (since I’ve sworn off Instagram during the week). I get out of bed at 7 while my husband, B., snores away. I decide to make an early morning Target run. I pick up milk, half and half, mozzarella cheese, a cucumber, peanuts, chips and salsa, rice, and frozen peas. $25

9 a.m. — Time to start the work week! I make coffee and then spend the next few hours in a meeting, writing up an article, cleaning out weekend emails, and chatting with my coworkers. I have a bowl of cereal around 10:30.

12 p.m. — B. decides to work from a cafe. He orders a cappuccino and a croissant ($11). I wrap up a meeting, make a salad for lunch and then go for a walk around the neighborhood. I have a $25 Starbucks gift card, so I treat myself to a cake pop and a tall iced coffee. $11

5 p.m. — I wrap up work for the day — I’m totally exhausted, but I have to trek out to a band rehearsal. I take the subway and bus, swiping my pre-loaded MetroCard. Before rehearsal, I stop for dinner at a falafel place. I get a falafel bowl with regular hummus, cauliflower, and veggies ($11.50). Meanwhile, my husband finishes work and treats himself to ramen and a beer ($32 with tip). After rehearsal, I bus and subway home using my pre-loaded MetroCard. Home by 10 and immediately crawl into bed. B. and I chat about our days and I read half a page of my book before falling asleep. $43.50

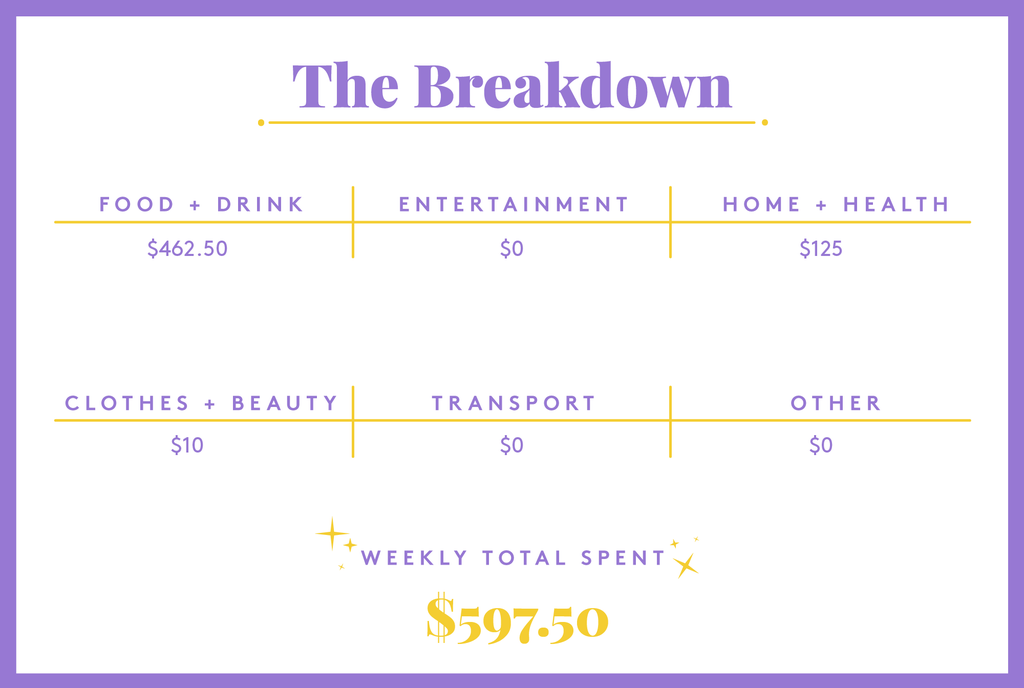

Daily Total: $79.50

Day Two

8:30 a.m. — I slept so well! I still feel bleary-eyed, but I’m up and out of bed around 8:50. B. has made coffee already and I fix myself a giant cup and settle in for the day. The morning flies by with work tasks and chatting. I take a break around 11:30 and go for a three-mile run around the neighborhood.

1:30 p.m. — I make a salad for lunch. While I was on my run, B. took a walk and picked up two cheddar and scallion scones from our neighborhood coffee shop, so I polish off one of those before diving back into work. I finish up a tedious article, update the website, edit a story, and look for more story ideas to fill my own plate. $6.50

4 p.m. — I take a break to go for a walk around the neighborhood. I’ve been stressing over some deadlines and still feel drained from a family weekend, so the outdoor time is a good reset. I contemplate stopping at a wine store on the way home but realize I forgot my wallet. My husband is also out picking up a prescription ($30) so I text him about the wine, but he misses it. We cross paths on the street and chat through our to-do lists for the rest of the day. Back to the apartment to finish up work! $30

6 p.m. — I wrap up work and tidy up around the house. I usually spend 10-15 minutes after work putting away dishes/clothes/vacuuming up the bathroom, etc. to signal the end of the day. Then I catch up on a few yoga videos. B. finishes up work and we hang on the couch. We have a glass of wine (left over from last week), chat about our days, and discuss what to get for gifts for upcoming family birthdays.

7:30 p.m. — I start making dinner around 7:30 — teriyaki tofu with bok choy over rice. I do 99% of the cooking and B. does the cleanup. Post-dinner, B. cleans and I spend an hour reading and texting with my sister. Around 10, we turn on our latest obsession, Junior Bake Off. I’m very sad about who gets eliminated and head off to bed around 11. B. stays up and reads the news.

Daily Total: $36.50

Day Three

7:30 a.m. — Going into the office today! Our company is mostly remote, so I almost never go to the office, but my boss will be in today and there will be free lunch. I take the subway (fare is covered by my MetroCard). I stop at a cafeteria-type place I used to like when I worked down here full time. I get a pack of gum and a pumpkin spice-flavored coffee, and also give myself a pump of pumpkin spice syrup. I later discover this was a horrible mistake. The coffee tastes disgusting. I make a Keurig coffee in the office and grab an RX bar from the office kitchen. I internally stress about wasting money on the coffee but talk myself off the ledge. $6

11 a.m. — I’ve spent the entire morning chatting with my boss and got no work done. I’m so much more productive when I’m working from home, but it’s really nice to have social time and see some people I never talk to anymore. I grab more lame office snacks and a bottle of water from the kitchen. Everyone is antsy for lunch… and to go home.

1:30 p.m. — Lunch is finally served! I fill my plate up with roasted veggies, couscous, and various salads. It’s really delicious and I spend more time chatting online with my other coworkers who aren’t in the office and scrolling through emails, resigned to the fact this day is a wash in terms of work.

3:30 p.m. — I’m fading fast. I try to revive myself with a nice walk around the work neighborhood. I call B. and we chat about our days. We decide to meet up for a drink later, like old times when we dated! The pandemic/job losses/new jobs/early marriage have all been challenging over the last few years, so it’s always nice to plan a “date night” and do something different from our normal weeknight routine.

4:30 p.m. — My boss and I wrap up early and go for a drink. We talk for an hour about work and life. She pays for the drinks and then I walk to meet B. On the way, I find an awesome print store with vintage posters, prints, and maps. I pick out a few samurai prints for B. and some botanical prints for myself. It feels great to be out and about in the city. $15

7 p.m. — B. texts me that he’s close to the wine bar so I head over — he put on a nice blazer for the occasion and looks so handsome. I get a glass of their house red wine and he gets a Manhattan. I’m quite a lightweight when it comes to drinking, so I’m going to need some food soon! We decide on a sushi place and walk over a few blocks after paying the check. $30

9 p.m. — The sushi place is packed, so we wait a bit before being seated. I get a spicy tuna roll and an eel avocado roll and B. gets chicken katsu. I skip my usual order of hot sake because the wine is hitting me, but B. gets a beer. We wrap up and walk back to the train and head home. Both fares are covered by our MetroCards. We end the night with another episode of Junior Bake Off and I head to bed around 11. $45

Daily Total: $96

Day Four

8:30 a.m. — Up with my alarm! I get up, brush my teeth, moisturize, and then head into the kitchen to make a big pot of coffee. I settle onto the couch for work and spend the morning organizing emails, looking for interview subjects, chatting with coworkers, and sitting in on a training meeting. The morning flies by. I have a bowl of cereal for breakfast around 10:30.

11 a.m. — Time for my weekly therapy appointment. B. heads to a cafe for the hour and gets a cappuccino and cinnamon roll ($10). The session whizzes by — after a lot of trial and error over the last four years, I finally found a therapist I really like and connect with. We discuss some upcoming family events (always a source of anxiety and stress for me), how things are going with my in-laws (… another source of stress), and how I can find time to relax over the weekend and fight the urge to do all the things, all the time. We end the session with a cleansing breath, and then I put on a five-minute Yoga With Adrienne meditation. Since I do therapy in the middle of the workday, I often finish the call and dive straight back into work without processing the session at all. Trying to take a few minutes to think through what we talked about and sit with my thoughts before heading back to work. The co-pay for my session is $80. $90

1:30 p.m. — Time for lunch — yet another salad, this time with tuna fish. I really want to spend some time this weekend making a big batch of chili or something we can have for lunches during the week. I finish the salad and fix myself an iced coffee with a bit of chocolate sauce and half and half.

3:30 p.m. — My window for weekly grocery delivery opens up — I signed up for Imperfect Foods about a year ago and we love it. It’s perfect for two people and the quality of the produce and meat is super high. I order kale, lettuce, tomatoes, zucchini, lemons and limes, chicken sausages, salmon, some canned beans, cheese sticks for B., cinnamon roll oat creamer for iced coffees, and a matcha latte can. $67

5 p.m. — I finish with work! Feeling totally exhausted from the day at the office yesterday and the therapy session today. While B. keeps working, I go for a long walk around the park near our apartment and enjoy the beautiful fall leaves and golden hour light. I feel so much better and head back to the apartment to do a little yoga and get dinner started.

8 p.m. — Time to eat! Tonight I make a zucchini and broccoli stir fry with gochujang sauce and white rice. It’s an Eric Kim recipe from the NY Times and it is so delicious. I roast the broccoli before adding it to the rest of the veggies — chef’s kiss! We each have a glass of white wine and chat about our days, upcoming deadlines, and weekend ideas.

10 p.m. — Time for more Junior Bake Off! I fix myself a bowl of Ben and Jerry’s ice cream, B. grabs a beer, and we settle in. Once again, I’m devastated by who they eliminate. All the kids are weeping! I head to bed at 11 and read for a half hour before shutting off the light.

Daily Total: $157

Day Five

8 a.m. — TGIF! Feeling totally exhausted and already unmotivated to work today. I do my best to inspire myself by getting up, making coffee, and reading a bit of my book before logging in for the day.

10:30 a.m. — B. and I are both having motivation issues today, so we decide to head to the cafe to work for a while. I get an iced Americano and B. gets a black coffee. I manage to wrap up an article and clean out my email inbox. I’m an inbox-zero girl and like to get everything tidy for the end of the week. $8

1:30 p.m. — B. and I leave the cafe and take a walk around the neighborhood. Since the idea of yet another sad lunch salad is unappealing, we stop at a bodega for some bacon, egg, and cheese sandwiches. $10

3:30 p.m. — Our team decides to wrap up early for the day! B. is still working, so I go on a long walk and call my sister.

7 p.m. — B. goes to a dentist’s appointment (free with insurance). He texts me that he’s cavity-free and asks if I want to meet him for a drink downtown, so I put on some real pants and a little blush and hop on the subway to meet him (using my prepaid MetroCard). We go to a great tiki bar and get some tropical drinks. I have a cocktail with mezcal, beet juice, and cacao nibs, which is odd but tasty, and B. gets a mai tai. $36

8:30 p.m. — We head next door for fried chicken sandwiches, but the line is out the door and the hostess is super rude. Cutting our losses, we walk a few blocks to a French restaurant and split a half carafe of red wine and each get a cheeseburger. I get a side salad with mine and B. gets fries. $75

10:30 p.m. — Home! We watch The Great British Baking Show. The bakers make apple cakes for their signature bake, and I make a mental note to buy baking supplies this weekend and make muffins. Off to bed around midnight.

Daily Total: $129

Day Six

8 a.m. — Up with the sun. I get up and make a pot of coffee. I read for a bit on the couch until B. gets up around 10.

11:30 a.m. — B. has to work so I go for a long seven-mile run. I feel pretty good until the last mile or so but I’m proud of myself for pushing through. I stop at CVS for a bottle of electrolyte water and then take the subway back home. $3.50

2 p.m. — B. is still working, so I sit on the couch with a book. I scrounge together a lunch of leftover rice, a fried egg, and some leftover cilantro yogurt sauce and snack on gummy bears.

3:30 p.m. — I decide to finally do some meal prepping for next week. I spend the next hour making a mushroom marsala pasta bake from Smitten Kitchen and a vegetarian chili. Between cooking, cleaning, waiting for things to cool, and boxing everything up, I’m done around 5. I do a yoga video to stretch out.

7:30 p.m. — B. wraps up work and we have a little argument about boundary-setting around work and keeping weekends mostly work-free. I know he’s been stressed about his job lately so I feel guilty getting upset, but it’s my weekend too and I like to spend time with him. He goes for a walk so we can both cool off. I’m still feeling mopey, but he convinces us to “salvage the day” by going to our favorite Mexican place a few blocks away. I get a margarita, a chicken tostada, and an enchilada with rice and beans. B. gets a chimichanga and a beer. We put the argument behind us and manage to have a pleasant dinner. $56

10:30 p.m. — B. gets a text from a friend asking if we want to go hiking tomorrow. She can pick us up at 8 a.m., which seems violent for a Sunday, but we agree to go. I head off to bed to get ready for an early wake-up call!

Daily Total: $59.50

Day Seven

7:30 a.m. — Alarm goes off and I am NOT ready to get up. Shockingly, B. springs out of bed and I hear him put the coffee on. I finally get up around 7:45 and put on my hiking clothes and boots. We manage to have a cup of coffee and B. puts some hiking snacks together — peanuts, string cheese, and a container of pretzels, along with a big jug of water.

8:15 a.m. — B.’s friend picks us up and we squeeze into her car with her husband and another friend.

9:30 a.m. — We get to the hike and begin our ascent. The trail is surprisingly crowded. We make it to the first lookout and take some photos. We hike for another 45 minutes before stopping for a snack. The trail just keeps going up, up, up! Finally, we make it to the top and take in the view before scrambling through the woods for an hour to get back to the trailhead.

12:30 p.m. — Make it back to the car and decide to head to a small town nearby for lunch. B. and both get coffee and an omelet. We split the bill with the rest of the group. $30

4 p.m. — We spend the next few hours meandering around the town, popping into bookstores and walking around the farmer’s market. B. spots gummy bear earrings and decides to get them for me, which is really sweet. We also stop at a coffee shop since the driver of the group is feeling tired. Then back to the car to head to the city. $10

6:30 p.m. — Made it back! We make plans to get dinner with the group soon. B. and I take showers and hang on the sofa for a bit. I heat up the pasta bake and make a salad to go with it.

10 p.m. — Another episode of Junior Bake Off in the books. I head to bed around 11, read for 10 minutes, and pass out.

Daily Total: $40

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Brooklyn, NY, On A $140,000 Salary

A Week In Philadelphia, PA, On A $92,000 Salary

A Week In Boston, MA, On A $202,000 Joint Income

from Refinery29 https://ift.tt/VfNTjoU

via IFTTT