Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an administrative assistant working in tech who makes $130,000 per year and spends some of her money this week on Double Chocolate Klondike bars.

Occupation: Administrative Assistant

Industry: Tech

Age: 29

Location: Rhode Island

Salary: $130,000

Net Worth: $19,188 (this breaks down to $23,009 in savings and $21,384 in retirement, minus debt).

Debt: $25,205 (I owe $5,291 for my car and $19,914 for student loans. I am eligible for the $20,000 forgiveness if that goes through).

Paycheck Amount (1x/month): $6,549.43

Pronouns: She/her

Monthly Expenses

Rent: $600 (I live with my fiancé, P., who owns the house. This is the amount we agreed on when I moved in two years ago. The total mortgage is $1,800 a month and I felt like this was fair at the time because I was making almost half my current salary and I don’t have equity in the house. We have a shared account that we keep enough money in for groceries and household items. Other than housing costs, we generally split everything 50/50. Our salaries are now pretty equal but he has more retirement savings. We may combine more once we are married).

Utilities: $75–150 (my half).

Student Loans: $0 (this will be $250 when payments resume).

Health Insurance: $61.59

Car: $229.29

Car Insurance: $105.23

Phone: $0 ($75, expensed through work).

Internet: $0 ($64.99, expensed through work).

HSA: $200

Hulu + Live TV: $42.49 (my half).

Unlimited Threading: $20

401(k): $866.66

Roth 401(k): $324.99

Savings: $1,500–2,500

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Not really. I put more pressure on myself to attend college because I saw it as a way to get out of my toxic situation and make a better life for myself. My brother didn’t finish high school and my sister wasn’t interested in college. If I went to school, I knew I would have to take out loans and pay for it myself. I went to a private university out of state and quickly realized that wouldn’t be sustainable so I transferred to an in-state university for the remaining three and a half years. My parents didn’t know anything about the system and weren’t very helpful with the student loan process. My mom actually cosigned a lot of my loans without my dad knowing (he didn’t trust I would be able to pay them back). I received a lot of financial aid and grants and paid for off-campus housing costs out of pocket. I graduated with $40,000 in debt.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

The only conversations around money were about our lack of it and about how bad credit cards and debt are. I felt like finances were constantly talked about but in a very stressful way.

What was your first job and why did you get it?

I started coaching gymnastics when I was 13 or 14 to stay close to the sport after I quit competing. Once I turned 16, I got another job at a healthy fast food place that paid more and offered more hours. I liked the independence I had from working and having my own money, which I knew I’d need to get to college.

Did you worry about money growing up?

Yes, like I said, it was always talked about in a stressful way, and I definitely fed off that energy. We always had a roof over our heads and food on the table but there wasn’t much for extras like annual school shopping or vacations. I also knew not to ask for anything and I paid for things like college applications, SATs and my prom dress myself.

Do you worry about money now?

Yes and no. I have come a long way from making $35,000 at my first job, living paycheck to paycheck and racking up $8,000 in credit card debt. I finally feel like I have a better relationship with money, can save for retirement and splurge on vacations. I do feel behind on savings, though, especially because we are paying for a wedding next year and New England weddings are extremely expensive. We wanted to stay under $30,000 and quickly realized that wasn’t realistic given the area and the fact that we want to do a full celebration. The budget is now $45,000 and we’ll split it three ways between me, my partner and his parents. We both have good savings so could pay for this now but I want to make sure we don’t wipe them out, especially because I would like to buy an investment property within the next few years.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became financially responsible for myself around age 19. I spent one summer after my freshman year of college at home and it was a very toxic environment. After that, I was pretty much on my own. I worked waitressing jobs throughout college to pay for rent, food and books. I am my own safety net but P. would support me if I lost my job, just like I would do for him.

Do you or have you ever received passive or inherited income? If yes, please explain.

My brother passed away when he was 21 and the insurance money went to my parents. They told my sister and I that they would split it with us three ways. The total for my share was about $18,000 but I had to ask for the money in increments. This served as my security blanket throughout college. My sister never received her share, which I have some guilt about. P.’s parents have told us they will contribute $15,000 towards the wedding but we haven’t received that money yet.

Day One

4:30 a.m. — Ugh! I am flying to my company’s HQ today and need to be there by 9:30 so I am on the first flight out. I take an Uber to the office, uncaffeinated. $44.98 (expensed)

8 a.m. — I get to our office and grab a cup of coffee (free) and buy a ham and cheese croissant ($4.11 expensed). I am running a strategy session today so I make sure the room is ready and schedule Sweetgreen to be delivered for lunch ($117.15 expensed). $121.26 (expensed)

12 p.m. — Sessions are going well and food arrives. I eat my garden Cobb and we continue.

6 p.m. — All done! Overall it’s a great day and one of the best sessions we’ve had. My boss drives me to the hotel to check in and then I log in for a meeting with a board member in Asia. Afterward, I order penne vodka and a Caesar salad ($33.03 expensed) through Uber Eats and grab a glass of wine at the bar while I wait for the food to arrive (charged to the room, which is also expensed). $33.03 (expensed)

9 p.m. — Watch Below Deck Sailing Yacht and lights out.

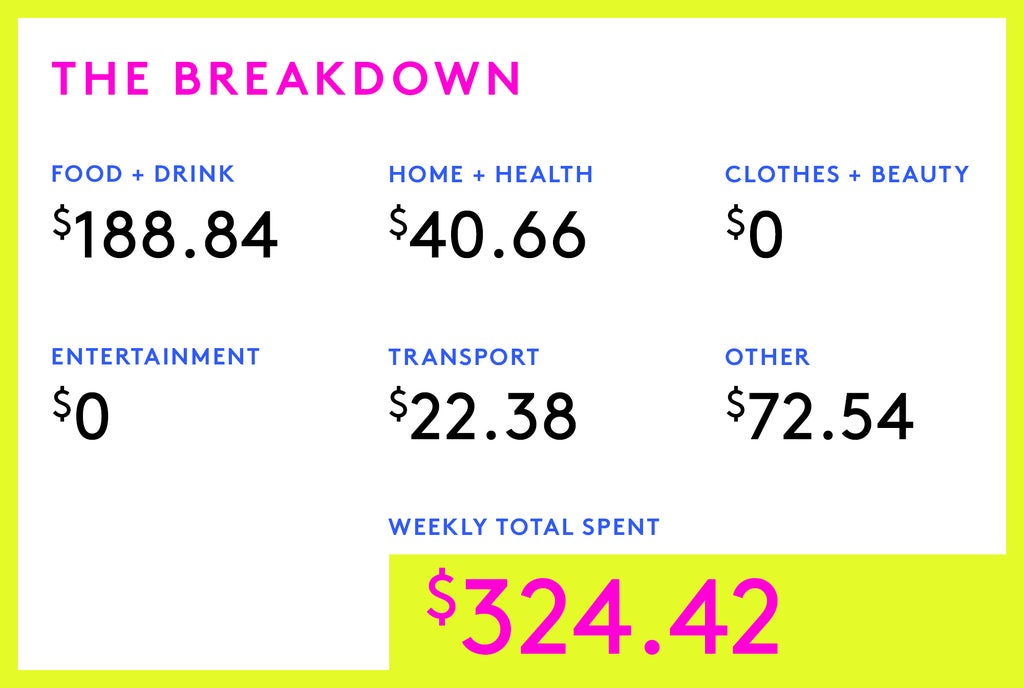

Daily Total: $0

Day Two

7 a.m. — That’s a better time for an alarm. Get up, dressed and check out of the hotel ($176.02 expensed). We have customer visits all day so I get to the office and help set up. Panera breakfast is provided for the customer so I grab a bagel and coffee and work at my desk. $176.02 (expensed)

12 p.m. — We are serving lunch to the customer as well so I grab a sandwich and chocolate chip cookie before finishing up a few strategy sessions we didn’t get to yesterday.

3:15 p.m. — I order an Uber to the airport ($64.96 expensed). I didn’t eat a lot for lunch so I go to P.F. Chang’s at the airport and get dumplings, a California roll and a glass of rosé ($61.97 expensed). I finish some work and board to go home! $126.92 (expensed)

7 p.m. — Landed! Pay for parking at the airport ($34.98 expensed). Finally get home and am greeted by my fiancé, P., and my overexcited dog, N. It’s a beautiful night so we hang outside and measure our tree for the outdoor swing P. got me for my birthday. I then shower, change and do my light skincare routine, which consists of hyaluronic acid and moisturizer. We met with a wedding caterer last week and owe them a suggested menu so P. and I sit down and put together a few options to get the proposal started. For food and bar, we want to stay around $150 per person. Our caterer has a BYOB option, which is helpful, but the drinks and food will still be around $25,000 to $28,000. $34.98 (expensed)

10 p.m. — I scroll through my phone in bed, then go to sleep.

Daily Total: $0

Day Three

7 a.m. — Alarm, snooze, lie in bed and scroll on my phone. N. jumps up on the bed and says good morning. He sleeps in a crate at night and P. is in charge of walking and feeding him in the morning because I am not a morning person. My usual routine is to put water on for my French press, change into athleisure, moisturize, watch the Today show while drinking my coffee, then hop onto work. I am fully remote, although I travel occasionally.

9:30 a.m. — Break for coffee and yogurt.

1 p.m. — Peel myself away from meetings to take N. on a walk. I love that having a dog has made me get out of the house during the day, especially since the weather has been beautiful. Afterwards, I heat up chicken sausage and peppers for lunch and snack on pita and hummus. We have a hodgepodge of leftovers to get through this week.

5 p.m. — Laptop closed! I’ve been following a running plan for a half marathon so I change into another pair of leggings and a workout top and go to the local bike path for a 30-minute run. I’ve been listening to podcasts while I run to keep me from getting bored. Today is Dax Shepard’s Armchair Anonymous with nurses telling crazy stories. Bless you all.

6 p.m. — Finish my run and stop at the grocery store for ground coffee. I also grab ketchup and Klondike bars (Double Chocolate all the way). P. and I have a shared card for groceries and household items that we each put $300 on per month, so this expense will be split ($9). I get home and make burgers on the grill for dinner with a side of macaroni salad. P. is at his golf league tonight and will eat when he gets home. $4.50

9:30 p.m. — P. is home after playing extra holes and having a few beers. I get ready for bed, say goodnight to the fam and am out.

Daily Total: $4.50

Day Four

7 a.m. — Alarm. P. negotiated last night that N. could sleep with us if I walk him in the morning so I get up, put on neighborhood-appropriate clothes and we go on a walk. Afterward, I feed him, make coffee and get dressed in shorts, a white T-shirt and an oversized pink button-down. I drink my coffee on the couch before starting my work day, which is again packed with back-to-back meetings. A note on my job: I provide strategic support to our CEO and C-Suite so I often get pulled into a variety of meetings with finance, HR, investors, customers and really anyone who makes the business run. My boss asked me to take on this role at the beginning of the year after he became CEO. Shortly after, I asked for a 30% raise because I felt my new role was at the director level and it was approved.

11 a.m. — I take N. for a walk and eat yogurt.

12:30 p.m. — I take a short break for lunch and heat up my leftover burger and macaroni salad. Then I do a quick clean-up of the kitchen before hopping back on to work.

4 p.m. — My friend, L., and I signed up for a women’s instructional golf league so I get ready in my golf skirt and polo, put on sunscreen and finish up a few work tasks before she picks me up.

7 p.m. — All done! This is our second week and it was a bit boring because we repeated our stations from last week. Admittedly, L. and I have been playing for about a year so we are a little more advanced than most of the others. It’s still a fun time, though. The instructors are all very positive and the women, who range in age, are so nice. After, we sit in Adirondack chairs and I order us two beers, cheesecake egg rolls and two chicken Caesar wraps.

8 p.m. — There is a local band playing tonight so P. and L.’s husband meet us at the course. We get a few more beers and watch the sun go down. The course is right on the water near a marina and it’s so pretty and relaxing. We finish up once the band is done and L. and I split the bill. $61.52

10 p.m. — Home and greeted by N., who acts like we’ve left him for ages. Drink a couple glasses of water and crawl into bed.

Daily Total: $61.52

Day Five

7:20 a.m. — It’s Friday! The Find My sound went off on my Apple Watch at 2 a.m. last night and I had trouble falling back to sleep so this morning is a struggle. I have a few early meetings so I make coffee, dress in biker shorts and a quarter-zip, and log on.

10:15 a.m. — I heat up more coffee and grab a yogurt.

12 p.m. — I go downstairs and make a chicken salad sandwich for lunch. Take N. on a walk, then sit at my desk while reading today’s Money Diary. I get distracted and start looking into my health benefits plan. I have my first therapy appointment on Monday and the insurance company couldn’t tell me how much it will cost. Looks like it will just be a copay but really, who knows? The lack of transparency on the cost to the recipient is my biggest complaint with our healthcare system. I had a surgery last year that my insurance company said didn’t need to be pre-approved and then they denied the claim afterwards, so I was on the hook for almost $20,000. It took me over a year of fighting to finally have it covered and the process caused a lot of unnecessary stress.

1 p.m. — Get back to work for a few final meetings of the day. We started summer Fridays this year, which means the office technically “closes” at 1 on Fridays but I have a few more meetings until 2. I’m hoping I won’t have to stay online for too much longer. It’s also a long weekend!

2:30 p.m. — I’m exhausted and call it quits for the week. I lie down and nap for about an hour, then get ready to go for a run.

5 p.m. — I finish my run and stop at the grocery store. I get a slice of Hawaiian pizza for dinner, a Caesar salad mix, two peaches, a cantaloupe and two Gatorades. I put it on our shared card so the total is $12.74 for my half. When I get home, I put the groceries away, feed N. and take a shower. P. is going away for a bachelor party this weekend so I am solo and looking forward to getting errands and chores done. I heat up the pizza and eat it while watching Selling Sunset. $12.74

8 p.m. — It is a lazy night for me. I have a Klondike bar and a few glasses of wine while finishing Selling Sunset, then put What to Expect When You’re Expecting on and go to bed around 11:30.

Daily Total: $12.74

Day Six

7 a.m. — No alarm but my body and N. are on a schedule. He cuddled in bed with me last night so we start the day with belly rubs.

8 a.m. — I am up and feeling productive! I made myself a to-do list for this weekend and I want to knock off a few things. I make coffee, deep-clean the fridge and eat yogurt with blueberries and granola. I go to Warby Parker to get my glasses tightened (free with my previous purchase), go to Ulta and get Supergoop! sunscreen ($40.66), then stop by Hobby Lobby for paint and markers for a welcome sign I’m making for my sister’s wedding party ($6.24). Target is my last stop and I do surprisingly well at not purchasing anything from the home section. I walk out with trash bags, sponges, chips, biker shorts and a L’Oréal illuminator I saw on TikTok ($50.81). $97.71

1 p.m. — Home and make a chicken salad sandwich with a side of chips. L.’s husband is also on the bachelor trip so we make plans to go for “appy hour” at a local seafood place. I shower, blowdry my hair and L. picks me up to go to dinner.

7 p.m. — L.’s friend also meets us and we get oysters, fries and lobster wontons to share with the table. I have a spicy margarita and a glass of wine, and we split the bill three ways ($50.84). We have a nightcap at a local martini bar. L. and I order two rounds and each get one of them ($30). $80.84

1:30 a.m. — The nightcap turned into tearing up the nonexistent dance floor at a bar. I buy two rounds of beers ($25.60) and L. buys us late-night pizza, then we get an Uber that I pay for ($22.38). $47.98

Daily Total: $226.53

Day Seven

8 a.m. — Ugh. I am too old for this hangover. I take it easy this morning and lie on the couch while watching The Ultimatum: Marry or Move On. Once I’m up for it, I make coffee and take N. on a walk.

10 a.m. — I have been slowly trying to get the paint off the welcome sign I’m making for my sister’s wedding party and as I finally get off the final bit, the glass falls into the tub and breaks. Ugh.

12:30 p.m. — It’s Father’s Day and P. is golfing with his dad, brother and uncle this morning. I head over to his parents’ house with N. for lunch. We enjoy the weather outside and play with N. before going in to eat bruschetta chicken, pasta and salad for lunch. I’m not very close with my parents (hence therapy) so it’s always nice to hang out with P.’s family.

4 p.m. — We leave P.’s parents’ house and I go to Home Depot to find another sign. The acrylic is expensive so I get a piece of glass instead ($15.49). On the way to my car, I get a Del’s Lemonade ($3.64). $19.13

6 p.m. — We spend the rest of the night on the couch relaxing. No surprise that P. is tired from the bachelor party. I go to bed around 10 so I can get up early for my day off!

Daily Total: $19.13

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Virginia On A $1,095,000 Joint Income

A Week In Fort Collins, CO, On A $91,753 Salary

A Week In New York State On An $80,000 Salary

from Refinery29 https://ift.tt/LX5A32s

via IFTTT